01-Keltner-Channel-1

Fri 14 November 2025

# Created: 20250103

import pyutil as pyu

pyu.get_local_pyinfo()

'conda env: ml312-2024; pyv: 3.12.7 | packaged by Anaconda, Inc. | (main, Oct 4 2024, 13:27:36) [GCC 11.2.0]'

print(pyu.ps2("requests"))

requests==2.32.3

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

# Step 1: Download historical data

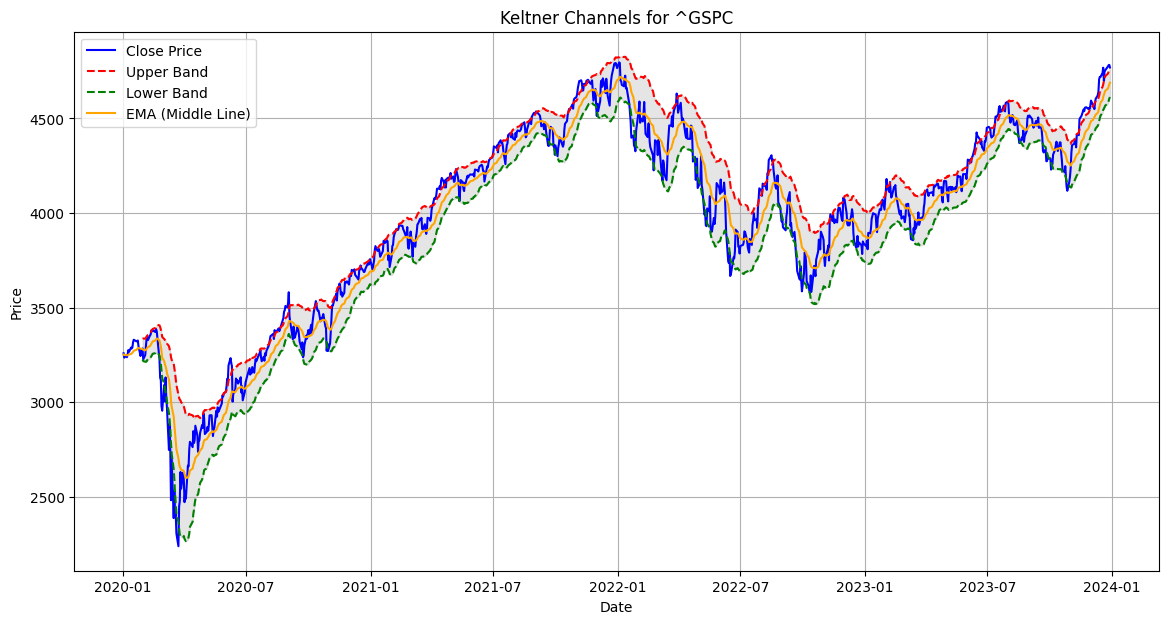

symbol = "^GSPC" # S&P 500 as an example

start = "2020-01-01"

end = "2023-12-31"

data = yf.download(symbol, start=start, end=end)

# Step 2: Calculate Keltner Channels

def keltner_channels(data, window=20, multiplier=2):

# Calculate typical price

data['Typical Price'] = (data['High'] + data['Low'] + data['Close']) / 3

# Calculate EMA of typical price

data['EMA'] = data['Typical Price'].ewm(span=window, adjust=False).mean()

# Calculate Average True Range (ATR)

data['High-Low'] = data['High'] - data['Low']

data['High-Close'] = abs(data['High'] - data['Close'].shift(1))

data['Low-Close'] = abs(data['Low'] - data['Close'].shift(1))

data['True Range'] = data[['High-Low', 'High-Close', 'Low-Close']].max(axis=1)

data['ATR'] = data['True Range'].rolling(window=window).mean()

# Calculate upper and lower bands

data['Upper Band'] = data['EMA'] + (multiplier * data['ATR'])

data['Lower Band'] = data['EMA'] - (multiplier * data['ATR'])

return data

# Apply Keltner Channel function

data = keltner_channels(data)

# Step 3: Plot the data with Keltner Channels

plt.figure(figsize=(14, 7))

plt.plot(data['Close'], label='Close Price', color='blue')

plt.plot(data['Upper Band'], label='Upper Band', color='red', linestyle='--')

plt.plot(data['Lower Band'], label='Lower Band', color='green', linestyle='--')

plt.plot(data['EMA'], label='EMA (Middle Line)', color='orange')

plt.fill_between(data.index, data['Lower Band'], data['Upper Band'], color='gray', alpha=0.2)

plt.title(f'Keltner Channels for {symbol}')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend(loc='best')

plt.grid(True)

plt.show()

[*********************100%***********************] 1 of 1 completed

# Step 2: Calculate Keltner Channels

def keltner_channels(data, window=20, multiplier=2):

# Calculate typical price

data['Typical Price'] = (data['High'] + data['Low'] + data['Close']) / 3

# Calculate EMA of typical price

data['EMA'] = data['Typical Price'].ewm(span=window, adjust=False).mean()

# Calculate Average True Range (ATR)

data['High-Low'] = data['High'] - data['Low']

data['High-Close'] = abs(data['High'] - data['Close'].shift(1))

data['Low-Close'] = abs(data['Low'] - data['Close'].shift(1))

data['True Range'] = data[['High-Low', 'High-Close', 'Low-Close']].max(axis=1)

data['ATR'] = data['True Range'].rolling(window=window).mean()

# Calculate upper and lower bands

data['Upper Band'] = data['EMA'] + (multiplier * data['ATR'])

data['Lower Band'] = data['EMA'] - (multiplier * data['ATR'])

return data

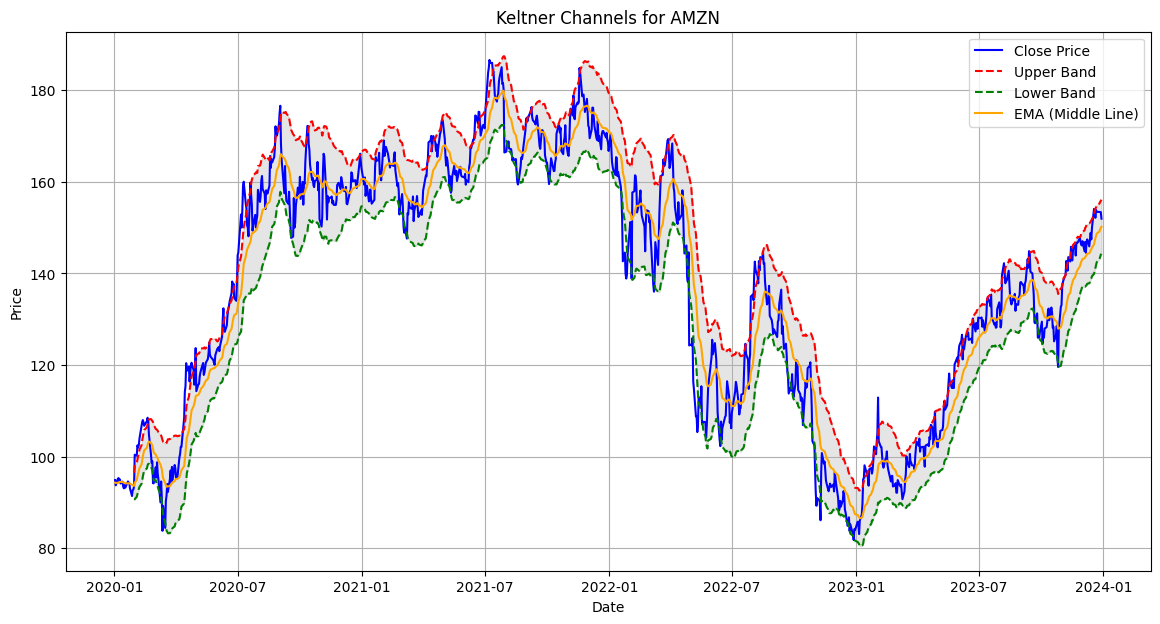

def show_keltner_bands(symbol):

# Step 1: Download historical data

start = "2020-01-01"

end = "2023-12-31"

data = yf.download(symbol, start=start, end=end)

# Apply Keltner Channel function

data = keltner_channels(data)

# Step 3: Plot the data with Keltner Channels

plt.figure(figsize=(14, 7))

plt.plot(data['Close'], label='Close Price', color='blue')

plt.plot(data['Upper Band'], label='Upper Band', color='red', linestyle='--')

plt.plot(data['Lower Band'], label='Lower Band', color='green', linestyle='--')

plt.plot(data['EMA'], label='EMA (Middle Line)', color='orange')

plt.fill_between(data.index, data['Lower Band'], data['Upper Band'], color='gray', alpha=0.2)

plt.title(f'Keltner Channels for {symbol}')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend(loc='best')

plt.grid(True)

plt.show()

show_keltner_bands("AMZN")

[*********************100%***********************] 1 of 1 completed

Score: 5

Category: stockmarket